AX Financials Certification Exam MB6-893

Note: This exam is retired.

For current exams, please read our Microsoft Dynamics 365FO Certifications and Exams Overview (axcademy.com)

Microsoft Dynamics AX Financials Certification Exam MB6-893

This preparation guide includes information and tools to assist you in preparation for the Microsoft Dynamics AX Financials Certification Exam MB6-893.

Target Audience

This exam is intended for partners that plan to implement, use, maintain, or support Microsoft Dynamics AX in their or their customers’ organizations. They should have a moderate understanding of Finance processes, but they are most likely not experts. They need an understanding of what AX functionalities apply to the different finance processes. This audience typically includes Microsoft Dynamics AX Partner staff, such as Solution Architects, Functional Consultants, and Project Managers. This exam is also appropriate for sales staff who have a business software solution background and want to demonstrate a foundational understanding of the Microsoft Dynamics AX application.

Exam Specifics

Skills being measured

This certification exam measures a candidate’s ability to understand and articulate how to use, maintain, and support the financials modules in Microsoft Dynamics AX. These modules include: General Ledger. Cash and Bank Management, Budgeting, Accounts Receivable, Accounts Payable, and Fixed Assets.

Time requirements

Microsoft Dynamics exam times typically range between 60 — 160 minutes. Note that this time does not include any additional time required for validating your identification, reviewing instructions, providing comments, and calculating your score.

Microsoft Dynamics exams typically contain between 40 – 75 questions

Multiple Choice and Multiple Answer questions

Registration

Register for Exam MB6-893 Microsoft Dynamics AX Financials. Information can be found on Dynamics Learning Portal.

Exam Preparation Tools

In addition to your hands-on experience working with Microsoft Dynamics AX, we highly recommend using the following tools and training to help you prepare for this exam:

Instructor-led training

E-Learning

80743: General Ledger Configuration in Microsoft Dynamics AX;

80744: Chart of Accounts and Ledger Balances in Microsoft Dynamics AX;

80745: General Ledger Setup and Review in Microsoft Dynamics AX;

80805: General Journals in Microsoft Dynamics AX;

80806: Intercompany Accounting in Microsoft Dynamics AX;

80807: Sales and Withholding Taxes in Microsoft Dynamics AX;

80808: Vendor Invoicing in Microsoft Dynamics AX;

80809: Free Text Invoices and Sales Order Invoices in Microsoft Dynamics AX;

80815: Vendor Payments in Microsoft Dynamics AX;

80810: Vendor Setup in Microsoft Dynamics AX;

80813: Vendor Invoice Journals in Microsoft Dynamics AX;

80812: Customer Setup in Microsoft Dynamics AX;

80814: Cash and Bank Setup in Microsoft Dynamics AX;

80816: Customer Cash Receipts in Microsoft Dynamics AX;

80817: Centralized Payments in Microsoft Dynamics AX;

80818: Prepayments in Microsoft Dynamics AX;

80819: Bills of Exchange in Microsoft Dynamics AX;

80820: Fixed Assets Setup in Microsoft Dynamics AX;

80821: Fixed Assets Depreciation in Microsoft Dynamics AX;

80822: Fixed Assets Management in Microsoft Dynamics AX;

80823: Fixed Assets Transactions in Microsoft Dynamics AX;

80825: Period End in Microsoft Dynamics AX;

80826: Customer Collections in Microsoft Dynamics AX;

80827: Vendor 1099s in Microsoft Dynamics AX;

80828: Cash and Bank Reconciliation in Microsoft Dynamics AX;

80829: Eliminations and Consolidations in Microsoft Dynamics AX;

80824: Budgeting in Microsoft Dynamics AX;

80830: Budget Planning in Microsoft Dynamics AX;

80831: Budget Control in Microsoft Dynamics AX;

80832: Commitment Accounting in Microsoft Dynamics AX;

80833: Management Reporter in Microsoft Dynamics AX

Supplemental learning resources

D365FOE Wiki; TechNet; MSDN; Dynamics AX wiki maintained by the Microsoft AX community; Courses on Currency and Exchange Rates in Microsoft Dynamics AX and Sales Order Invoicing in Microsoft Dynamics AX

Additional skills recommended

Previous application experience in AX2012, AX2009, and AX4.0 will aid in understanding concepts.

Exam Topics

1. Set up and Configure the Finance Modules (15-20%)

1.1. Define and Format the General Ledger Module

This objective may include but is not limited to: Define Currency and Exchange rates; define and create the Chart of Accounts and Account Structures; set up Fiscal Calendars, Years, and Periods; create and define financial dimensions and financial dimension sets; create period allocations; set up journals; define the General ledger parameters

1.2. Format the Cash and Bank Management Module

This objective may include but is not limited to: Define bank transaction types and transaction groups; set up bank groups; create Bank Accounts; define the Cash and bank management parameters

1.3. Understand the Accounts Receivable Module

This objective may include but is not limited to: Define customer posting profiles; set up Customer payment information; create customers; define the Accounts receivable parameters; define an organizational structure for centralized payments

1.4. Define the Accounts Payable Module

This objective may include but is not limited to: Define vendor posting profiles; set up vendor payment information; define invoice matching; create vendors; set up vendor 1099 information; define the account payable parameters; define an organizational structure for centralized payments

1.5. Set Up and Configure the Fixed Assets Module

This objective may include but is not limited to: Define depreciation methods and conventions; set up depreciation profiles and books; set up value models; define Fixed Asset parameters; create Fixed assets; set up and assign bar codes to assets; lend fixed assets

2. Set up, Configure, and Process Sales Tax (15-20%)

2.1. Define Sales Tax Setup Procedures

This objective may include but is not limited to: Define Ledger posting groups; create sales tax codes; create sales and item tax groups; define sales tax authorities; define withholding tax

2.2. Understand Sales Tax Transactions

This objective may include but is not limited to: How to revise sales tax prior to posting a transaction; post sales tax on prepayments; create transactions with conditional sales tax

3. Set up Basic Budgeting and Budget Planning (10-15%)

3.1. Understand Budgeting Concepts and Types

This objective may include but is not limited to: Define budget concepts; discuss different budget types

3.2. Set up and Configure the Budgeting Module

This objective may include but is not limited to: Define and set up the different budget configurations; define the Budget Parameters

3.3. Define and Generate Budget Plans

This objective may include but is not limited to: Define Budget planning configuration; create budget plans; process budget plans; modify budget plans in Excel

4. Create Budget Register Entries (15-20%)

4.1. Process Budget Register Entries

This objective may include but is not limited to: Transfer budget balances; define budget allocations; update budget register entries in Excel; create budget register entries

4.2. Process Register Entries from Budget plans

This objective may include but is not limited to: Create budget register entries from budget plans

5. Manage Financial Daily Procedures (20-25%)

5.1. Review and Process General Ledger Daily Procedures

This objective may include but is not limited to: Create voucher templates; process periodic journals; process period allocations; create and process accrual schemes; reverse a transaction; create reversing entries

5.2. Process and Understand Cash and Bank Management Daily Procedures

This objective may include but is not limited to: Create and delete checks; void a check and create payment reversals; create and cancel deposit slips; reconcile bank accounts

5.3. Create and Process Accounts Receivable Daily Procedures

This objective may include but is no limited to: Create free text invoices; process prepayments; create payment journals; reverse Settlements; reimburse a customer

5.4. Review and Process Accounts Payable Daily Procedures This objective may include but is not limited to: Define and create different types of invoice journals; manage vendor invoices; process prepayments; create payment journals

5.5. Review and Process Fixed Asset Daily Procedures

This objective may include but is no limited to: Define transaction types available; process acquisitions through the general ledger and purchasing modules; process depreciations; process disposals; process value adjustments, review fixed asset information

6. Set up and Use Collections Management and Consolidations (10-15%)

6.1. Configure Collections settings

This objective may include but is no limited to: Set up and process collection letters; set up and calculate interest; process interest adjustments; set up customer pools and aging period definitions

6.2. Manage collections information

This objective may include but is not limited to: Review aging snapshots; process customer statements; create write-off transactions; add activities to transactions through the collections screen

6.3. Define Consolidations settings

This objective may include but is not limited to: Set up and define a consolidation company; add consolidation information to main accounts

More information about exams

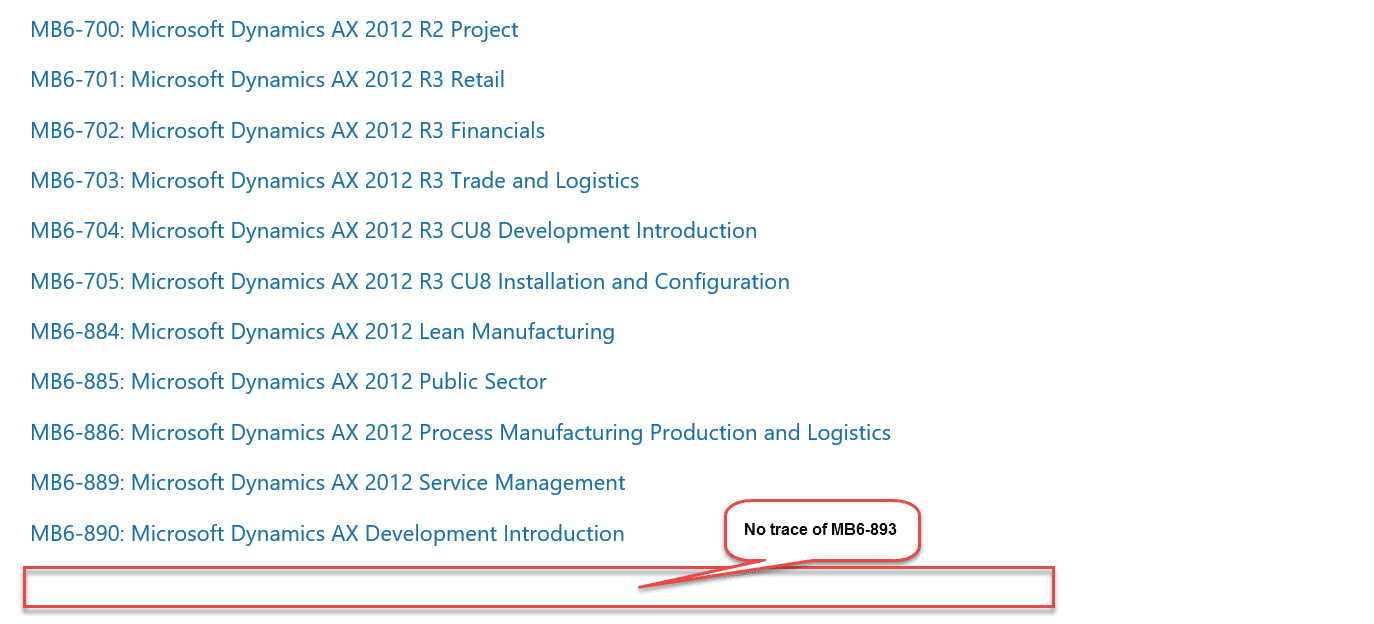

View the complete list of Dynamics 365 FOE and AX Certification Exams